AscendArc’s $200M+ Satellite Deal Signals a New Era in Space-as-a-Service

Ascend Arc provides bandwidth as a service from proprietary geo stationary satellite hardware.

AscendArc just secured a deal that redefines how the satellite industry does business. The company has sold two geostationary Earth orbit (GEO) satellites to Space Leasing International (SLI) for over $200 million—but the real story is how it’s enabling the shift from space infrastructure ownership to space infrastructure leasing.

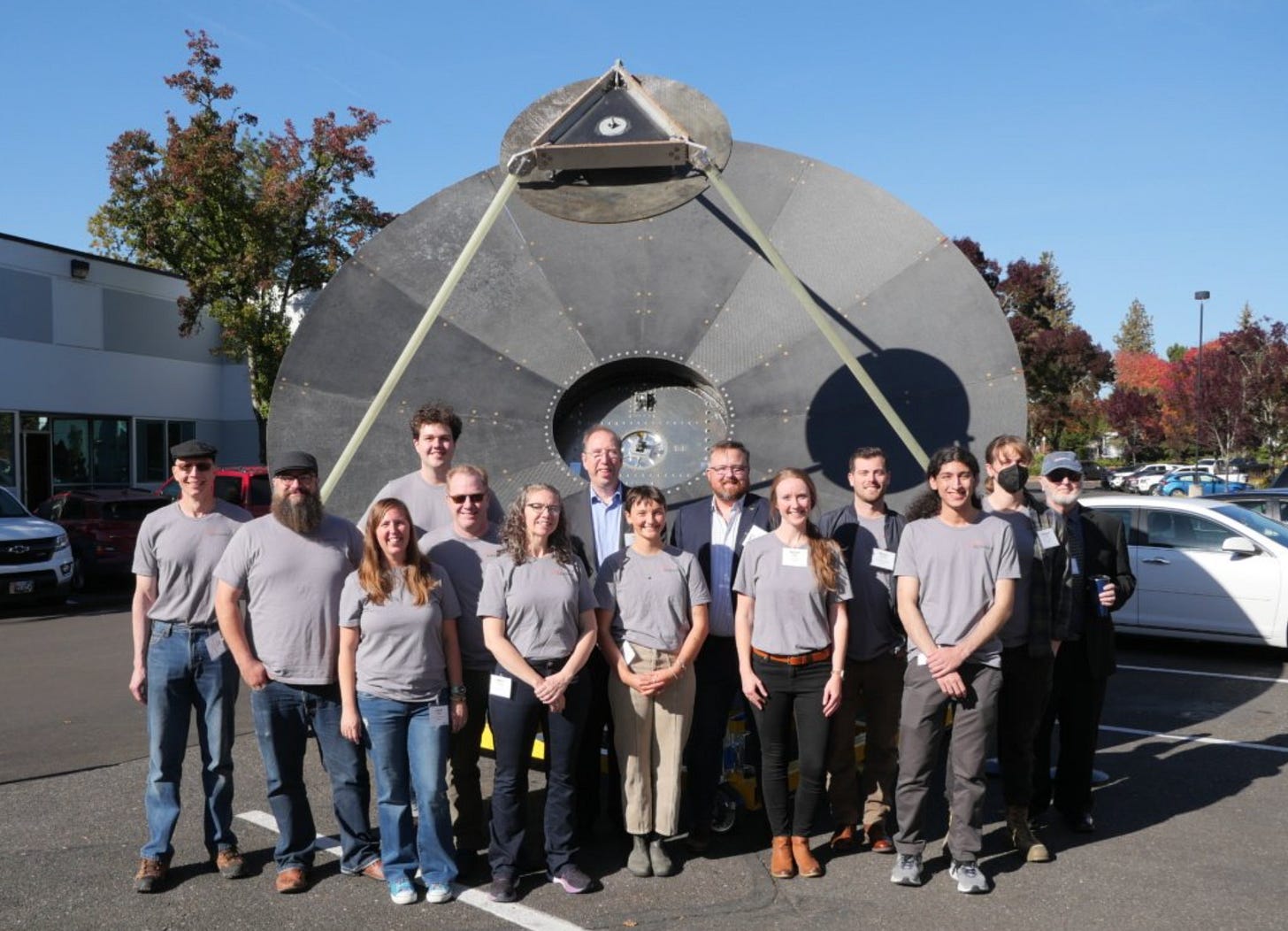

Founded by Chris McLain, AscendArc is a newcomer in the satellite space that’s moving fast. Backed by Seraphim Space, the company is building small, high-performance GEO satellites that aim to deliver better economics and throughput performance at a time when operators are desperate for more capital-efficient options.

From CapEx to OpEx: The Rise of Satellite Leasing

The agreement with SLI marks a major milestone in making “space-as-a-service” a mainstream business model. Instead of purchasing satellites outright, operators will now be able to lease AscendArc satellites, freeing up working capital while still benefiting from cutting-edge orbital assets.

SLI’s CEO Praveen Vetrivel emphasized this new value proposition: “We expect operators to appreciate both the performance profile and the ability to access this technology through leasing terms that allow them to grow in a capital-efficient way and free up capital for other priorities.”

It’s a playbook taken from the aviation and maritime sectors—industries where leasing has long been the norm. Backed by the Libra Group, which has deep roots in high-value asset leasing, SLI is aiming to replicate this same dynamic in orbit.

Why GEO Still Matters

AscendArc is part of a new wave of players looking to make GEO relevant again by shrinking the hardware, lowering costs, and accelerating innovation. GEO orbits, once dominated by large, expensive satellites with 15-year timelines, are now being targeted for reinvention.

Unlike low Earth orbit (LEO) constellations, GEO satellites cover more ground with fewer assets. AscendArc’s compact GEO design combines the reliability and coverage of high-altitude orbits with the iteration speed and cost profile of smaller, lower-orbit spacecraft.

The company has already partnered with KT Sat, the satellite subsidiary of Korea Telecom, and is now expanding commercial reach through its new leasing model with SLI.

Laying the Groundwork (Literally)

SLI isn’t stopping at satellites. The company already owns 13 ground stations through a partnership with RBC Signals, offering secure communications in every major frequency band. These stations span Sweden, South Africa, Chile, Singapore, and the U.S.—with more on the way.

Together, AscendArc’s orbital assets and SLI’s global ground coverage are creating a vertically integrated leasing ecosystem that dramatically lowers the barrier to entry for space connectivity.

A Downstream Revolution Is Coming

According to Dr. Maureen Haverty, investment principal at Seraphim Space, the capital-heavy phase of space tech is giving way to a downstream boom—where the data satellites produce becomes the most valuable product.

“Companies like AscendArc are making satellite connectivity cheaper than fiber,” she said. “That shift will open up whole new commercial models.”

From AI-based insurance to climate data platforms, the applications of this new infrastructure will only grow more diverse. And with leasing models like AscendArc’s, customers no longer need to be deep-pocketed governments or multinationals to participate.

Read more on DataCenter Dynamics

Listen to Prashanth Vijay, with Scott Hartley on the Venture Everywhere podcast: Follow the Fiber with Flume. Now on Apple & Spotify. Check out to all our past episodes here!