Want to Trigger a Venture Capitalist? Hire an EA or Chief of Staff at the Earliest Stages of the Business

Jenny Fielding’s snarky comment on Twitter sparked a lively debate around cash management but what she was really getting at is a warning to founders: make every dollar count.

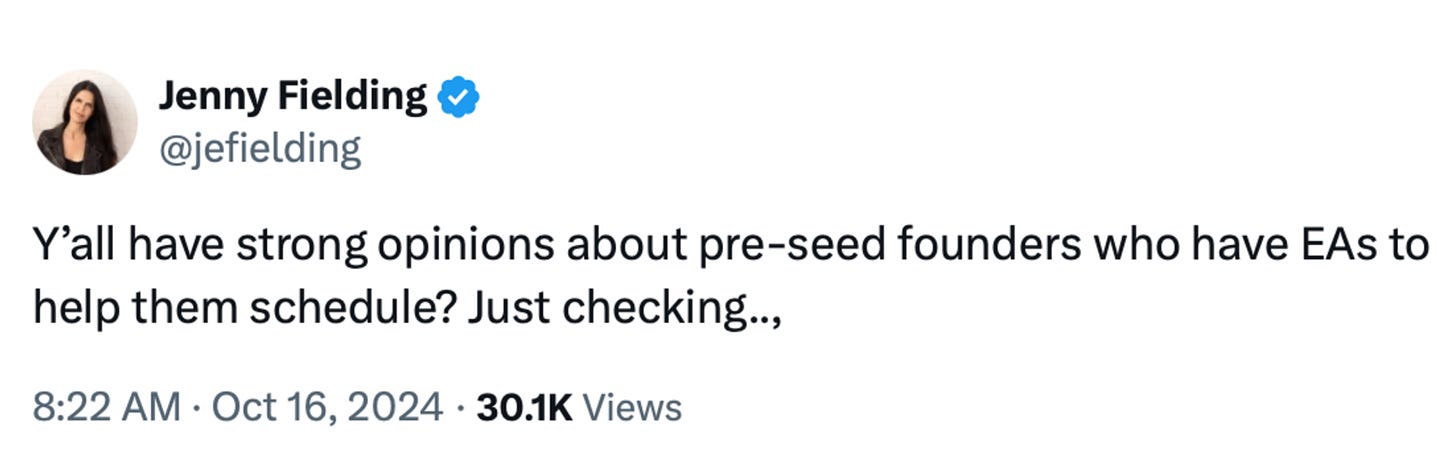

In a cash constrained venture market where every dollar counts, investors want to feel confident that their cash is being spent on critical things that move the business forward - rather than nice-to-have extras long associated with the excess of the bull market. One of those perceived ‘extras’ at the early stage is an executive assistant that helps with scheduling and other administrative tasks. Jenny Fielding, co-founder of Everywhere Ventures recently sparked a lively debate on X (formerly Twitter) with a simple but snarky post:

While some defended hiring executive assistants (EAs) as efficient, others questioned their necessity during the scrappy early days of a startup. Fielding clarified her stance: “Founders still hold some misconceptions from the excess funding days of 2020-2021 about appropriate cash management.” At the pre-seed stage, she emphasized, the focus should be on building products and acquiring customers—not adding unnecessary overhead.

The Red Flags: Roles and Salaries

Fielding highlighted two key areas where early-stage founders often misstep:

Unnecessary Roles

Executive Assistants: While invaluable at later stages, hiring an EA at the pre-seed level can signal misplaced priorities. “It’s operational overhead, not someone supporting the early product,” Fielding explained.

C-Suite Roles (COO or CFO): These roles often add high costs without clear contributions. In some cases, they reflect an expensive “third co-founder” arrangement, which burdens the startup with additional stock and salaries.

Excessive Salaries

Fielding recalled walking away from a deal where a founder’s $300,000 salary consumed a significant chunk of the budget. At the pre-seed stage, she explained, reasonable founders salaries range from $85,000 to $125,000. “We’re not saying you should make $100,000 forever,” she noted, “but at the early stage, you just don’t have that cash to burn.”

The Big Picture: Building, Not Burning

Drawing on her experience as both a founder and investor, Fielding stresses the importance of lean operations. Early-stage startups should prioritize building products, acquiring customers, and generating revenue before worrying about organizational structures or high salaries.

Thoughtful spending not only preserves runway but also signals discipline and focus to investors. “I try to give founders the real information they need, not the fuzzy stuff,” Fielding said.

In a world where every dollar matters, lean operations aren’t just practical—they’re essential for long-term success.

Read more on TechCrunch

Listen to Marty Ringlein with Andy Ambrose on the Venture Everywhere podcast: Let’s Agree to Agree.com. Now on Apple & Spotify— check out our past episodes here!