Founders often ask me, “how should I improve my pitch?” The advice I most often give is what I call the “hourglass” narrative structure, or storytelling framework. No example is so apt as the example of a Broadway audition to express the idea that everyone gets the same script, the same words on the page, but one person gets the part. Why is that? It’s because that person best expresses the character, the emotional gravitas, the weightiness of the words, the arc of the narrative, the best. Nothing makes me eye roll harder than someone telling me “I also had that idea.” It’s not about getting the script or having the words; it’s about how well you tell the story. The difference between acting on Broadway, or landing that Series A, is storytelling. For those of you who already know this, that’s because it’s Chapter 1 of my book.

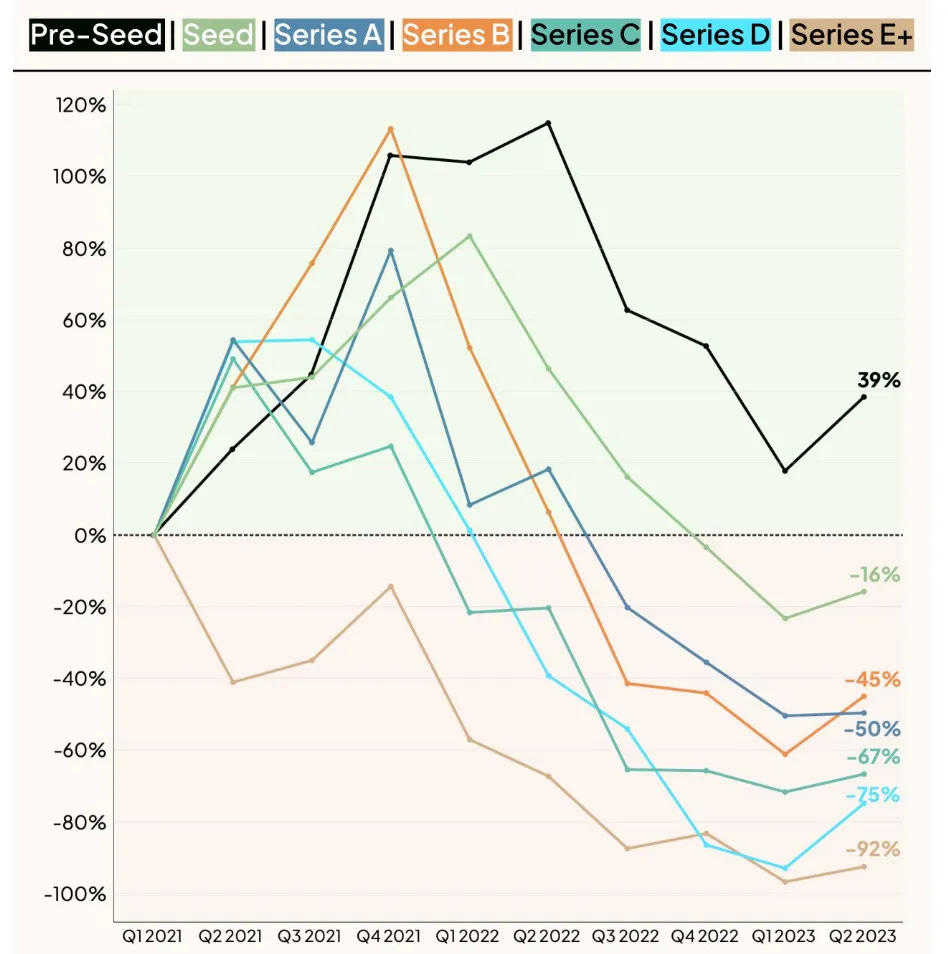

Furthermore, as the above chart shows in a fantastic overview by Carta’s Peter Walker of the 2023 funding landscape, fundraising just got tougher, particularly at stages after Pre-Seed and Seed. This means your story matters even more in a world where effectively there are more people at the audition competing for capital.

Aside from sector (industry) or stage (amount of investment and valuation) fit, there are a few gating factors for why a venture capitalist may pass on investing in your company. Firstly, they might not see the opportunity as big enough to be a fund returner. This is something that’s hard to understand, even for angel investors for whom a cash on cash return is great, but VCs run funds that are made up of third-party capital, and they have to return all of that capital to LPs before they ever get paid. As we’ve discussed previously, VCs operate by "Power Law” dynamics whereby a single outlier exit in a fund must alone be able to return the entire fund and offset losses. So what this means is if you have a $100M fund that typically is owning say 10 percent at entry, and 5% at exit net of dilution, the gating factor for an exit of sufficient size would be $2 billion (i.e. $100M / 0.05 = $2B). When they’re considering an investment, this is the math happening the VC’s head as to size of opportunity.

As a founder, you must therefore communicate the size of this opportunity, and make the VC understand and believe that 1) your market size, and your very specific TAM and SAM for your business are sufficiently large that at a reasonable amount of penetration, say 1-5% market penetration, you could easily become a $2B company. This is the wide funnel of the hourglass (on the left side of the picture). This is how you start your pitch, namely, you explain how HUGE this market and problem are.

The second gating factor a VC will look for is “are you the right person to be solving this problem?” Are you being authentic, are you passionate, are you a gritty-as-hell person who is going to fight when it gets hard in year 4 or 5 and keep at it even when the chips are down, when you’re out of cash, and your co-founder quits on you? Are you a fighter, and are you a humble, coachable, fast iteration, flexible-minded person?

The third gating factor is “can this person execute what they’re telling me they can?” This is the narrow part of the funnel in your narrative structure. Whereas you start your pitch with how big the opportunity is and why you are willing to dedicate the next decade of your life to solving for a problem that can easily be a $2B company, the second phase of your pitch is laser focus. You zoom into the first “bowling pin” that you’re going to knock down, and better yet, you’ve already been executing on. You are laser focused on this one very attainable, very addressable go-to-market, and better yet you’ve proven you can conquer this path with all the right signals. Those signals would be that you have early customer adoption, pilots that are converting to paid programs with scaling average order values (AOVs). You’re showing that clients demand what you’re building, and they’re willing to pay for it. You’re also showing that you’re able to acquire them on reasonable sales cycles, at a low customer acquisition cost (CAC), and through a diverse range of acquisition channels that scale (i.e. not paid acquisition, not ads, not Facebook. Rather, content, partnerships, SEO). You’re showing that your lifetime value (LTV), or early willingness to pay and AOVs, retention, and value derived from customers vastly exceeds your CAC. This narrow part of the funnel is you telling your investor, “I’m laser focused, and I OWN this.”

Big Vision.

Narrow Execution and Traction.

And That’s Not All.

This is the part of the narrative structure that isn’t just Vision, this is Traction. The left side of the funnel starts with Big Vision, the narrow middle is Traction and laser focused execution, and then, you guessed it, you zoom back out at closing and talk about Vision again. The right side of the hourglass is again you zooming out to tell the investor, with a grin, And That’s Not All. You’re hungry. What you’ve done is adroitly taken the investor through a story that is Big Vision, Laser Focused Execution, and then Big Vision again to show them that you’re focused yet hungry. The zoom out at the end of the pitch tells the investor that you’re building something generational, something beyond a Feature, Product, or even a Company. You’re focused on knocking down bowling pins two, three, four as you expand markets, and you’re building a Platform, or maybe even a new Category or Movement.

Don’t tell the story that you’re building a feature, a product, or a company. That’s not worth your time. Sell the vision that you’re creating a platform, a category, or a movement.

This narrative structure works. I can tell you having written over 400 checks into 300+ companies over 12 years in venture capital. This is the structure I coach founders to execute against because it’s the arc and Vision / Traction / Vision sandwich I love. The reason also is because buying vision is emotional, and buying traction is rational.

Emotional buys happen at a premium. Rational buys happen at a discount. Therefore you want to start and end your pitch with emotional resonance with your investor, because this is how you get them off the fence. Vision sells at a premium, so if you’re trying to make the impossible happen, you’re trying to get that large check and that justification on valuation, this is why starting and ending with Vision in the hourglass works. Having the metrics is essential, but that’s a moving target, and a shifting goal post. The truth is that investors, like founders, need to find passion in the reasons they’re digging in, and the way you communicate this is through the fat ends of the hourglass: Vision. Try it out and, and when friends ask you how they can improve their pitch, tell them about this Hourglass narrative structure. I promise, it works.

Vision sells at a Premium. Traction sells at a Discount. Lead and end with vision.

Also available via LinkedIn Newsletter.

—

Scott Hartley is Co-Founder and Managing Partner of Everywhere.vc. You can read more from him here.