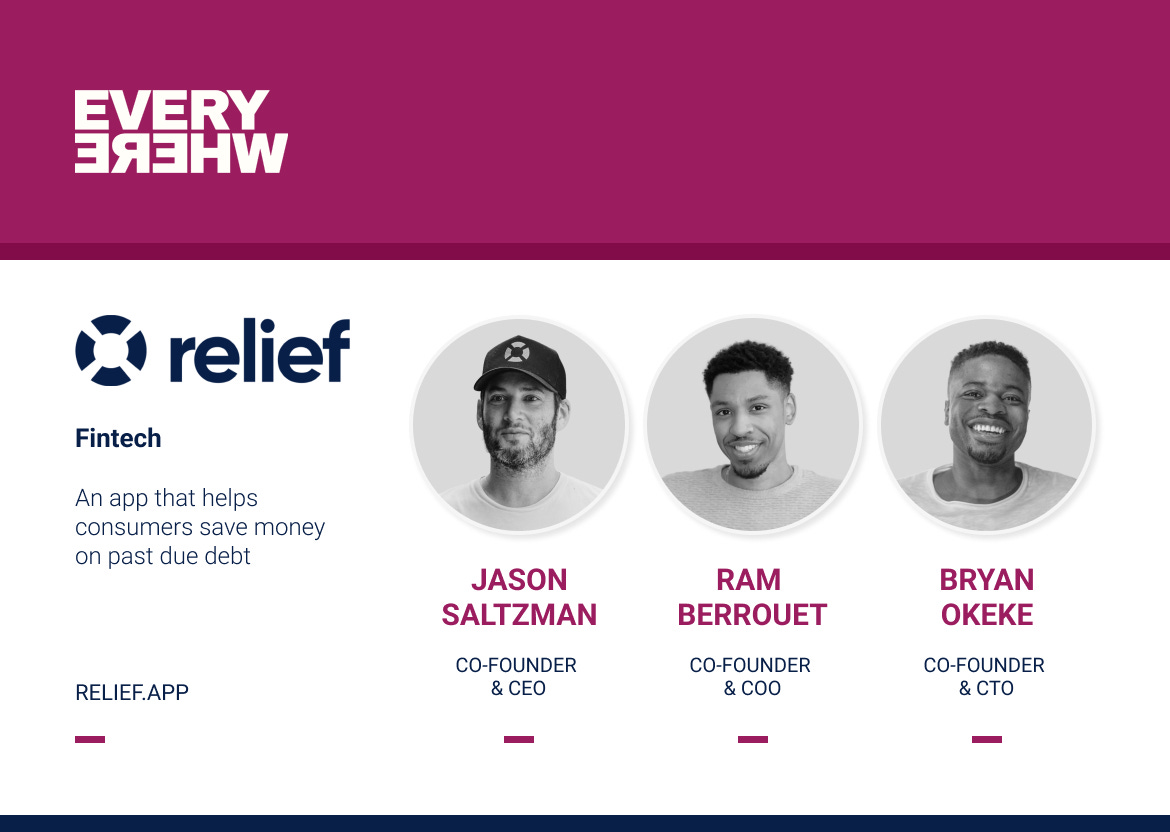

Founders Everywhere: Jason Saltzman, Ram Berrouet, and Bryan Okeke

Jason Saltzman, Ram Berrouet, and Bryan Okeke, are the co-founders of Relief, an app that helps consumers save money on past due debt.

Welcome to Founders Everywhere, where we highlight the incredible people behind the companies we’ve backed at Everywhere Ventures, a global pre-seed fund supported by a community of 500 founders and operators.

Debt is one of the most overwhelming challenges Americans face today,—impacting not just their finances, but their mental health, relationships, and overall well-being. Around 77% of households have some type of debt, and one in three people are behind on their bills. Traditional debt relief services that claim to “help” consumers are outdated, confusing, and often predatory. Relief is addressing this problem by providing consumers with a modern, app-based solution to manage and settle their debts. They automate the process, simplify communication with collectors, and give people the power to take control of their financial future.

Relief was co-founded by Jason Saltzman (CEO), Bryan Okeke (CTO), and Ram Berrouet (COO). Jason is a serial social entrepreneur, with deep knowledge of the debt space. He has founded multiple companies across industries with several successful exits. He partnered with Bryan and Ram, longtime friends and collaborators, who have strong technical backgrounds and a love for the user experience. The duo previously built consumer applications and launched the first coding class at Alley, Jason’s former incubator in New York City. Relief was developed during the height of the pandemic with a shared belief that technology and innovation can help solve America’s consumer debt crisis and that getting out of debt shouldn’t be so hard.

Why Relief and why now?

Jason: I started in the debt relief space 25 years ago and launched my first business after working at a debt company and seeing firsthand how much room there was for improvement. Even after all these years, nothing has changed for consumers. There’s been innovation in collections and debt buying—but not for the people who are actually struggling. When the pandemic hit, friends and family started calling me saying, “I’m behind on my debt and out of work—what do I do?” That’s when it clicked. Relief was born out of necessity. There was no modern, user-friendly solution for people to get out of debt—just late-night infomercials and scare tactics. The space was wide open, and I knew it was time to build something better.

What’s Relief’s North Star?

We want to relieve people of financial anxiety by helping them settle their debts, but it goes much deeper than that. One in three Americans is behind on their bills and that takes a huge emotional toll. It affects people's self-worth and they often hide it from their partners and loved ones. Financial issues are one of the top causes of suicide and divorce, so with Relief, we didn’t just want to make getting out of debt easier—we wanted to give people a way to do it on their own terms and preserve their dignity. The problem is complex, but the solutions can be simple. At the end of the day, we're not just building a product—we're trying to save lives.

Tell us about some milestones that Relief has crushed.

We’ve enrolled 140,000 users, representing over $6 billion in consumer debt on the platform. On average, we're saving people over 50% on their past-due debts—and in some cases, up to 70%. From a business perspective, our revenue has been growing steadily—50% month over month.

What sets Relief apart?

Currently, we focus on helping people in collections—those who are 60-90 days past due on payments. Downloading the app is free, and users can connect their accounts to see if we can assist them. Unlike other services that charge exorbitant fees (up to 25% of enrolled debt), we’ve automated negotiations using software to reduce costs significantly. We charge only 5% of the savings we achieve for users, making our service more accessible. While our MVP primarily serves this group now, we’re rapidly expanding features to address pre-collection debt and student loans.

What drives you as founders?

We've been building companies for a long time and it’s given us a deep sense of resilience. We've learned not to chase the hype or glamor, but stay grounded in purpose. Choosing a meaningful vision and mission is what sustains you. Knowing that we might help someone save money, restore their dignity, or change their life—that’s what fuels us.

Fun Facts:

Jason: I’m an amateur poker player! The strategic thinking required in poker mirrors the skills needed for entrepreneurship—analyzing risks and making calculated decisions.

Bryan: I have my own homemade McChicken recipe that I make every week.

Ram: I was 10 the first time I drove a car.

Listen to Stephen Sokoler with Matthew Brimer on the Venture Everywhere podcast: Mental Wellness is a Journey. Now on Apple & Spotify and check out all our past episodes here!