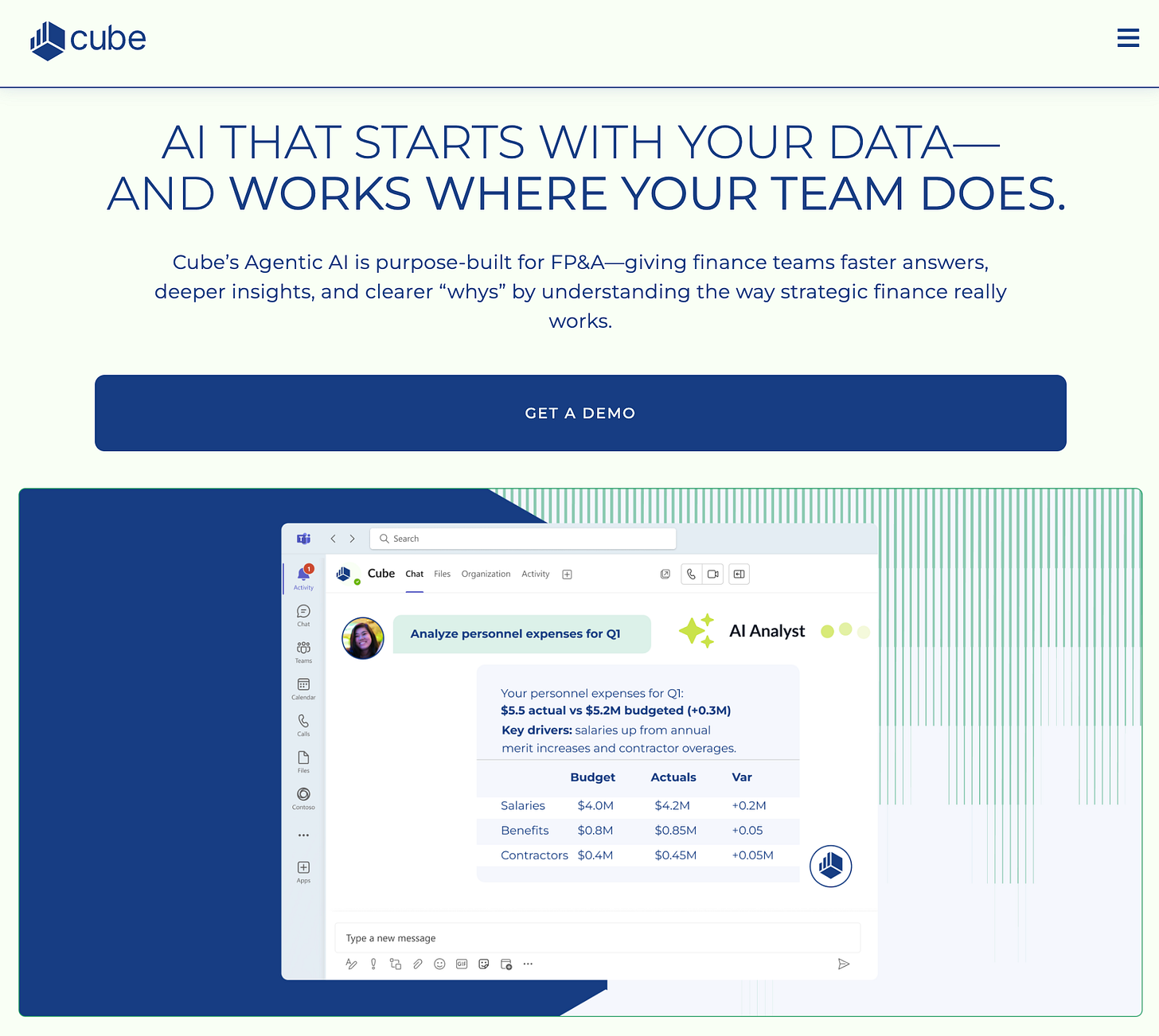

Planning on Every Platform: Cube’s AI Suite Brings Finance Into the Flow of Work

Cube is a financial planning and analysis (FP&A) platform that streamlines budgeting, forecasting, and reporting processes by integrating real-time data and eliminating manual consolidation.

CFOs today aren’t planning quarterly—they’re planning constantly. With shifting global markets, inflation concerns, and talent shortages across accounting and finance, teams are under pressure to deliver real-time insight while still working across messy spreadsheets and disconnected tools.

Cube, the FP&A platform founded by former CFO Christina Ross, is stepping into that complexity with a newly launched suite of AI apps built to streamline the finance workflow—wherever that workflow lives.

AI That Meets Teams Where They Are

“Planning happens once a year” is no longer the norm. “It’s constant,” Ross told CFO Dive. But despite years of modernization efforts, most finance teams “are still planning in Excel 99% of the time,” she said. Meanwhile, marketers stick to Google Sheets and executives often rely on Slack.

Cube’s new AI suite connects those fragmented workflows—allowing finance leaders to query, analyze, and share data across platforms using natural language. Reports built in Excel, still the “lingua franca” of finance, can now be turned into interactive dashboards shared instantly with stakeholders across the business.

“That entire workflow would have required one person at the center to manage all these relationships, to manage all the data, to manage all the files, to perform calculations on their own,” Ross said. “This is now all done with a button click at each step.”

From Messy Data to Meaningful Forecasts

Cube’s suite includes smart forecasting tools that can identify trends and patterns from historical data and seasonal transactions to help predict revenue, expenses, and more. Ross sees this as part of a broader evolution in how CFOs use technology to shift from tactical operators to strategic advisors.

“It is a huge need when we think about the world of accounting and the fact there aren’t enough accountants in the world anymore,” she said. “This is where AI can actually help humanity to both fill the gap and also help take sort of the grunt work out of the land of accounting.” Unlike automation tools that simply move tasks faster, AI can clean, contextualize, and explain data. That’s critical for finance teams looking to reduce manual overhead while maintaining full visibility and control.

An Analyst That Sits Beside You, Not Instead of You

Ross doesn’t see Cube’s AI as a replacement for finance professionals—but as a new kind of teammate. “It doesn’t replace someone,” she said. “It is that analyst sitting next to you saying, here’s what I found. You can now go a layer deeper and try and understand the story behind the story.”

Transparency remains top of mind. Cube’s AI analyst includes sourcing details and explanations behind every number. “You will still need an expert in every function,” Ross said, noting that even in a future where AI automates much of the accounting process, roles like the controller remain essential. “What a controller does is, it’s this person assessing and building controls.”

A Platform Built by Finance, For Finance

Cube isn’t chasing shiny AI trends—it’s addressing real pain points for real finance teams. From strategic planning to data transparency, the new AI suite is designed to augment human expertise, not replace it.

As Ross puts it: “For the last decade plus… automation helped to take finance from the back office to the boardroom.” Cube’s latest tools aim to take it one step further—bridging gaps, surfacing insights, and letting leaders spend less time wrangling numbers and more time driving the business forward.

Read more on Yahoo!Finance

Listen to Omar Haroun with Scott Hartlery on the Venture Everywhere podcast: Augmented Intelligence with Eudia. Now on Apple & Spotify and check out all our past episodes here!