Nigerian Banks Lost ₦52 Billion to Fraud Last Year. Pastel Has a Plan.

Pastel is an AI-driven platform revolutionizing fraud detection, anti-money laundering , and credit decisioning for African financial institutions.

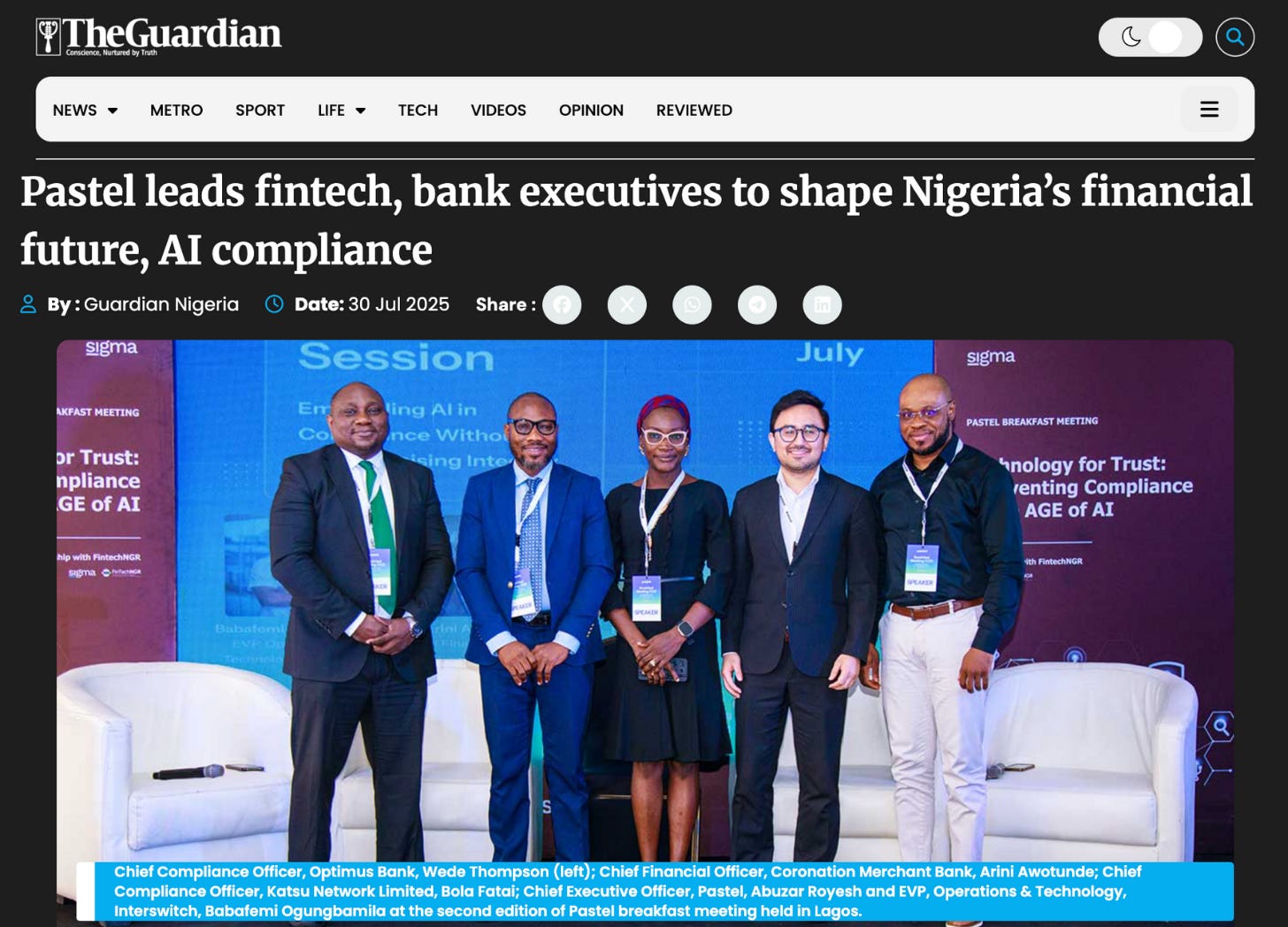

Pastel, an AI-powered enterprise solution provider founded by Abuzar Royesh, is stepping up to help banks combat fraud and modernize compliance across Africa’s fast-moving financial landscape. At a recent high-level breakfast meeting hosted in partnership with FintechNGR, Royesh and his team brought together executives from banks, regulators, and fintechs to tackle one urgent question: how can African institutions stay ahead of growing financial threats while remaining transparent, trustworthy, and compliant?

The urgency is real. According to Nigeria’s Inter-Bank Settlement System (NIBSS) Fraud Report, banks lost ₦52.26 billion to fraud in 2023—nearly triple the amount from the previous year. That’s in addition to the $50 billion Africa loses annually to illicit financial flows. With 12 African countries on the FATF greylist, there’s now increased scrutiny on cross-border transactions and greater pressure to raise compliance standards.

Sigma, Built for Africa

Pastel’s response is Sigma: an AI-powered compliance platform tailored specifically for African banks and regulators. Unlike Western systems retrofitted for local needs, Sigma was purpose-built using African regulatory models, datasets, and risk frameworks—including standards from the Central Bank of Nigeria (CBN).

“Manual reporting and fragmented monitoring can no longer keep pace with today’s threats,” said Anthony Amodu, Chief Revenue Officer at Pastel. “Sigma offers the speed, clarity, and accountability that C-suite leaders now require—not just to stay compliant, but to stay competitive.”

Sigma is already being deployed by Nigerian institutions, offering automated anti-money laundering tools, fraud detection models, and real-time compliance reporting. By using AI to monitor complex transactions at scale, Sigma enables financial institutions to spot anomalies, reduce human error, and meet rising regulatory expectations.

Trust, Transparency, and Collaboration

The event highlighted a growing consensus: AI must not only enhance compliance but also build trust. As Wede Thompson, Chief Compliance Officer at Optimus Bank, explained, “Regulation is ultimately about trust. If we’re going to use AI, we need alignment between banks, fintechs, and regulators—with the customer in mind.”

Other leaders echoed the importance of transparency. Babafemi Ogungbamila of Interswitch emphasized the need for explainability and accountability in AI-powered systems, while Arini Awotunde of Coronation Merchant Bank underscored the ethical dimensions: “Innovation and ethics must move together.”

Yeyetunde Caxton-Martins, Head of People and Operations at Pastel, closed the event by reaffirming the company’s commitment to industry-wide collaboration. “Sigma is how we help institutions move from burden to advantage,” she said.

With the cost of non-compliance rising and trust in financial systems on the line, Pastel’s approach offers a locally grounded, tech-driven path forward—one designed not just to fight fraud, but to redefine what smarter, safer compliance can look like in Africa.

Read more on The Guardian

Listen to Jenny Fielding with Colin Horsford on the Venture Everywhere podcast: The Tax Muse. Now on Apple & Spotify and check out all our past episodes here!