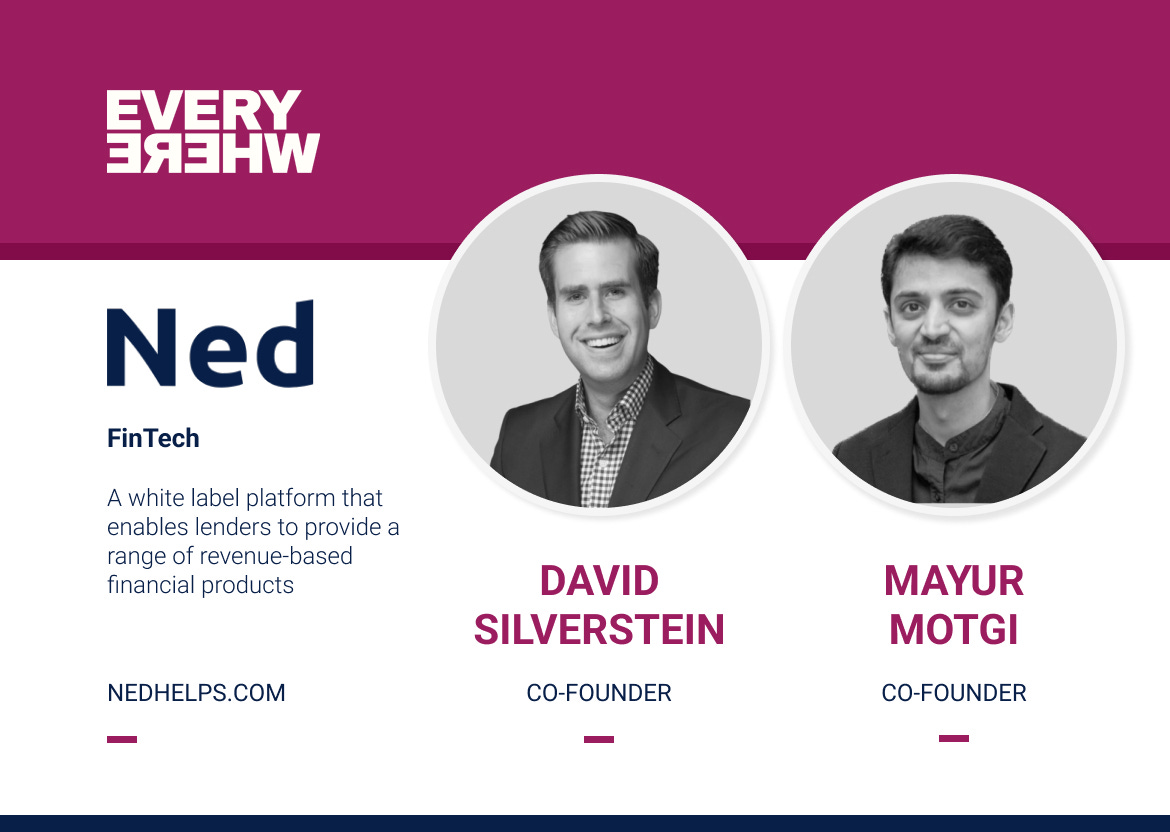

Founders Everywhere: David Silverstein and Mayur Motgi

David Silverstein and Mayur Motgi are the co-founders of Ned, a white label lending platform that makes it effortless to qualify borrowers and deploy capital.

Welcome to Founders Everywhere, where we highlight the incredible people behind the companies we’ve backed at Everywhere Ventures, a global pre-seed fund supported by a community of 500 founders and operators.

Access to capital is crucial for economic development. Businesses rely on lenders so they can grow but it’s harder than ever to qualify for capital. For the past 25 years, Fintech has primarily been built for massive financial institutions - it’s clunky, expensive, and it mostly facilitates traditional lending products that aren’t fit for today’s economy. Altogether, lending technology isn’t easily accessible or even usable for the vast majority of lenders on the front lines trying to serve the 31 million small businesses in the United States. Ned is addressing these challenges by providing lenders with infrastructure that’s customizable, affordable, and which makes it easy to deploy new financial products for the millions of business owners without credit or collateral.

David Silverstein, co-founder of Ned, was inspired to create the company after his friend -a small business owner- was struggling to secure funding during the pandemic. He felt that the issue had little to do with the business owner, but instead because lenders couldn’t offer the right financial product to serve his friend’s growing business. David was introduced to Mayur Motgi, who was working on a similar business problem and they quickly realized they were aligned in their vision. David is CEO and Mayur is the Chief Product Officer and together they’re working so lenders across the country can innovate and grow. They just raised $1.6M to strengthen their category-defining, end-to-end solution that helps lenders launch new revenue-based financial products.

What’s Ned’s Northstar?

We make it effortless for lenders to deploy capital. And we aren’t just solving a “lender problem.” We’re a white label platform and our ultimate end users are our “customer’s customer” - the small business owners. In general, business owners see a high rejection rate when they apply for financing; it’s so hard for them to borrow money. We want to help lenders expand their loan books by making it easy to configure and launch altogether-new financial products that are faster to administer and lower cost to manage. We aim to drive economic growth - we’re optimizing today’s lending economy with critical infrastructure, and we're growing it when our customers qualify borrowers that they couldn't serve beforehand.

How does Ned inspire customer love?

We start customer conversations with, “Tell us about how you want to offer your borrowers something new?” It frames a dialogue that’s growth-oriented and aspirational, and then we help them deliver.

We’ve found that small business lenders are excited to meet their borrowers’ needs, but are hard pressed to do so. Re-thinking or creating a new financial product, having the right tech to qualify more borrowers, etc., it’s all been an out-of-reach luxury reserved for the biggest financial services players (and even they struggle with the same issues).

For some of our customers, we are their first end-to-end operating system. Our product is built specifically for their needs - their operation, their team’s workflows, and so they can serve specific types of regional businesses. We want our technology to be flexible and empower lenders to think strategically and create different financial products that support their borrower’s dynamic requirements. We love seeing our customer’s excitement when we help them do more in minutes with our platform, than they could previously do in weeks or months.

Tell us about some milestones Ned’s crushed.

We’re pleased to announce that we just closed a $1.6M pre-seed round. It’s a nice way to end the first chapter of our business building experience. We’re working with a number of incredible lenders in almost every region across the United States. We just onboarded a customer that’s going to be powering their first $1MM loan on our platform, which for us indicates the scale that our platform can handle.

What sets Ned apart from competitors?

Our technology is straightforward and affordable. Many competitors provide nuanced point solutions or focus on certain parts of the lending process. We offer a seamless end-to-end experience across the entire lending value chain.

Our platform also powers lending products with revenue-based repayments. We believe this type of lending - where a borrower pays back based on their business’ performance - will be ubiquitous and preferred in the US economy. For our customers, this repayment capability enables them to underwrite based on cash flow and move away from traditional underwriting which relies on collateral or credit scores, things that most business owners lack.

What drives you as a founder?

David: I spent a number of years as a staffer to the former Senate Majority Leader, Harry Reid. I was inspired by his philosophy of standing up for those who couldn’t fight for themselves. We called it “the good fight.” I aim to apply that spirit here and continue with that legacy.

Mayur: I grew up in India and had the opportunity to come to the US and become an entrepreneur. Building this company has been a dream and I’m loving every moment of it. We’re building for the people who need it and I’m looking forward to the next few years.

Want to join Ned’s team? They’re hiring a Senior Software Engineer! Apply here.

Read more about their $4M seed round.