Existential vs Price Risk in VC

Early-stage risks are very different than growth-stage risks

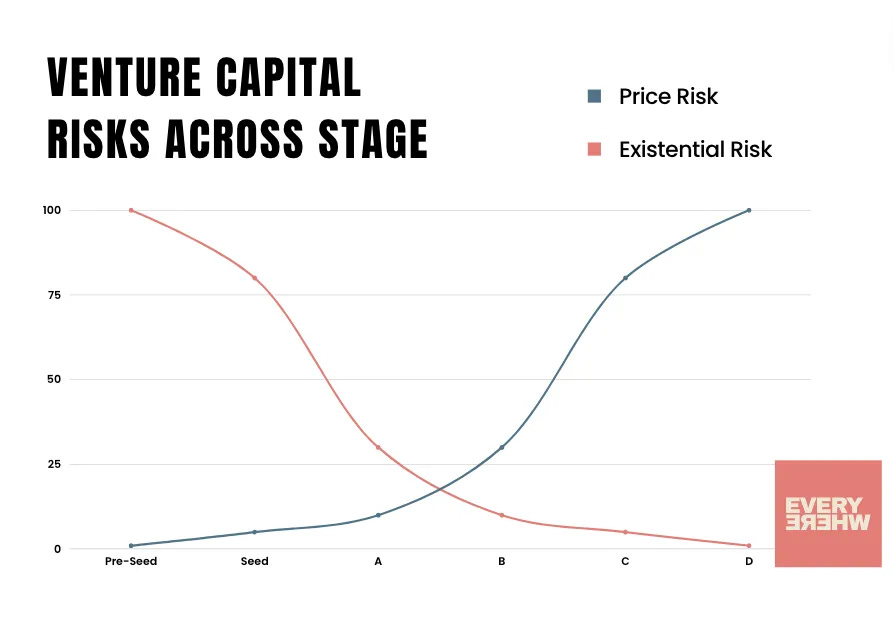

I spend a lot of time talking to people about venture capital, and also spend a lot of time talking about risk. But not all risks are created equal, and moreover, better understanding what type of risk you’re up against helps you counteract it with different strategies and tactics. Investing across the capital stack exposes the investor to fundamentally different types of risk, with fundamentally different requirements to mitigate it. For example, as early stage investors at Everywhere Ventures, we are primarily subject to what I would call Existential Risk (ER). This is the risk that the startup simply does not work. It’s a good idea, but it’s missing in timing, product market fit, or founder grit to survive long enough in the market. The existential risk is the non-zero chance that the company goes to zero, and it’s a donut. On the other hand at the earliest stages of company life, if the company works, and if it works in a big way, whether you get in at a $5M valuation or a $8M valuation is less material. In other words there is very low Price Risk (PR). So at the early stage you have high existential risk, and low price risk, so the best risk mitigating strategy is to build a large portfolio, be valuation disciplined but also open-minded to finding the breakouts, knowing that you have far lower price risk than existential risk.

Moreover in a tougher market, as you know price risk is less important, smart pre-seed investors will focus on breadth of portfolio, and also backing companies in a way that further mitigates existential risk. Namely, put together bigger rounds, or invest in bigger rounds even if you’re sacrificing on price, because what you are also doing is playing a risk mitigation strategy to bring down existential risk by giving your companies more runway, more ability to hire in a down market, and attack market.

As you move up in stage, you move down in existential risk, and you move up in price risk. In other words, by Series B or C or D the likelihood that a company purely goes to zero falls drastically. But on the other hand, your risk of over-paying, or investing at too high a valuation, become greater and greater. Thus the risk mitigation in growth rounds is very different than in pre-seed or seed rounds. Whereas for early stage portfolio, and concentration risk are greater in a more existential environment, at the later stages investors must be highly focused on price, and making sure you’re controlling for that variable by looking at comps, multiples, LTV, revenue, and a number of other KPIs. For a nuts and bolts finance person, growth investing makes more sense because these are risks one can rationalize and get comfortable with. The wild west of a company going to zero, or existential risk, is scarier to them. To us, as pre-seed investors, we love this risk, because we know how to measure, manage, and mitigate it. This is where we thrive as a community-driven fund where we can validate founder grit, perseverance, psychology and other soft skills via their peers. Some people say this is investing with your “gut,” but when you understand that existential risk is different than price risk, you realize that there’s a method to the madness.

The biggest risks are not understanding what risks you’re managing. At the early stage you need to build portfolio. If you can’t write enough checks to do this, invest in a fund, become an LP. And if you want to play a concentrated strategy, invest after existential risk goes away, and do your best to manage price risk. The hardest place to invest, I think, is at the Series A. This is where there is a non-zero risk of both existential risk, and price risk. This is where the integral of risk stacks up, and if you’re not careful, you have two paths to losing. Understand the risk, but know that each of these risks can be managed, and good investors know one from the other.

Also available via LinkedIn Newsletter.

—

Scott Hartley is Co-Founder and Managing Partner of Everywhere.vc. You can read more from him here.