Founders Everywhere: Rob Whiting

Rob Whiting is the co-founder and CEO of Boom, a startup building the future of rental financial services.

Welcome to Founders Everywhere, where we highlight the incredible people behind the companies we’ve backed at Everywhere Ventures, a global pre-seed fund supported by a community of 500 founders and operators.

Boom is building modern rental financial services for the 120 million U.S. renters and the real estate operators that serve them. For renters, credit history is extremely important, as it influences their ability to secure a lease. But how can they build credit if they don’t have a credit history (the classic chicken and the egg dilemma)? The answer is Boom, and as a Consumer Reporting Agency (CRA), they report customers' rental history to all 3 credit bureaus (Equifax, Experian, and TransUnion). With higher credit scores, not only does it make it easier to secure a lease, it also opens doors to better financial opportunities, such as lower interest rates on loans, credit cards, and mortgages. For landlords and property managers, the tenant screening process has long been plagued by inefficiencies and outdated practices, causing unnecessary pain and costs for both renters and landlords. Their newest product BoomScreen is transforming the process, making it more simple, efficient, and affordable.

Co-founder and CEO Rob Whiting has a background in consulting and entrepreneurship and has lived all over the world. He’s passionate about tackling the major challenges the average American faces and has worked in the 'big 3': healthcare, education, and now housing with Boom. He started the company in 2020 and his co-founder Kirill Moizik, a software engineer, joined a year later after Rob spent months sending cold outreaches on LinkedIn. It just goes to show how what Rob describes as "brute force" can influence the recruiting process on both sides. He shares more about his journey and how Boom is transforming the lives of renters and landlords across the country.

What inspired the creation of Boom?

When COVID hit, my brothers lost their jobs in the restaurant industry and couldn't afford their rent. I was already exploring the housing and financial services space so I went down that rabbit hole of rental assistance, affordable housing, credit, and rental applications. In addition, one of my brothers had an error on his credit report and he was paying a lot of money to a service to get that removed. It fueled my interest in discovering improved solutions for credit building, rental applications, and screening. I used this experience, along with my own 15 years as a renter, to learn more about the space and created Boom as a solution.

What’s Boom’s North Star?

We’re working to make housing more flexible, affordable, and rewarding. We started with credit building, with rent reporting. Now we’re expanding into tenant screening, which is a hairy, ugly, and non consumer-friendly space that needs to be cleaned up. Overall, affordable and accessible housing is a complex problem and we're eating the elephant one piece at a time.

Tell us about a recent milestone Boom crushed.

We just launched and publicly announced our tenant screening product BoomScreen, involving over a year of development. We launched with many thousands of units on the platform, just by word of mouth, with some of the biggest names in single family, multifamily and manufactured housing. We’ll be announcing some of these soon.

How does Boom inspire “customer love”?

We serve both consumers (renters) and businesses (landlords and property managers) and they value the rapid support they receive and our product actually works. We deliver what we say, and do it at about a quarter of the price of other vendors.

And more specifically:

Renters: They love our product because they are able to build credit and see impressive improvements to their credit scores.

Landlords: They love us because we develop our products in close collaboration with them and they appreciate the configurability, ease of use, and detailed data.

What are some of the challenges you’ve faced as a founder?

Personally, one of the biggest challenges I faced was just starting. I think a lot of ex-consultants struggle with this, with this disease of overanalyzing things. But, once I started, I just kept going. In terms of the business, we've built a product-led, highly technical team, but in many verticals, and especially in real estate, product alone doesn't always win. Factors like relationships and brand are crucial, so we're focusing on improving in those areas to effectively communicate our product's value.

Fun Facts: I’ve lived all over the world, including China, where I was an intern and learned enough Mandarin to get by. I lived in India where I started my first company. I also hitchhiked my way across Africa and Central America.

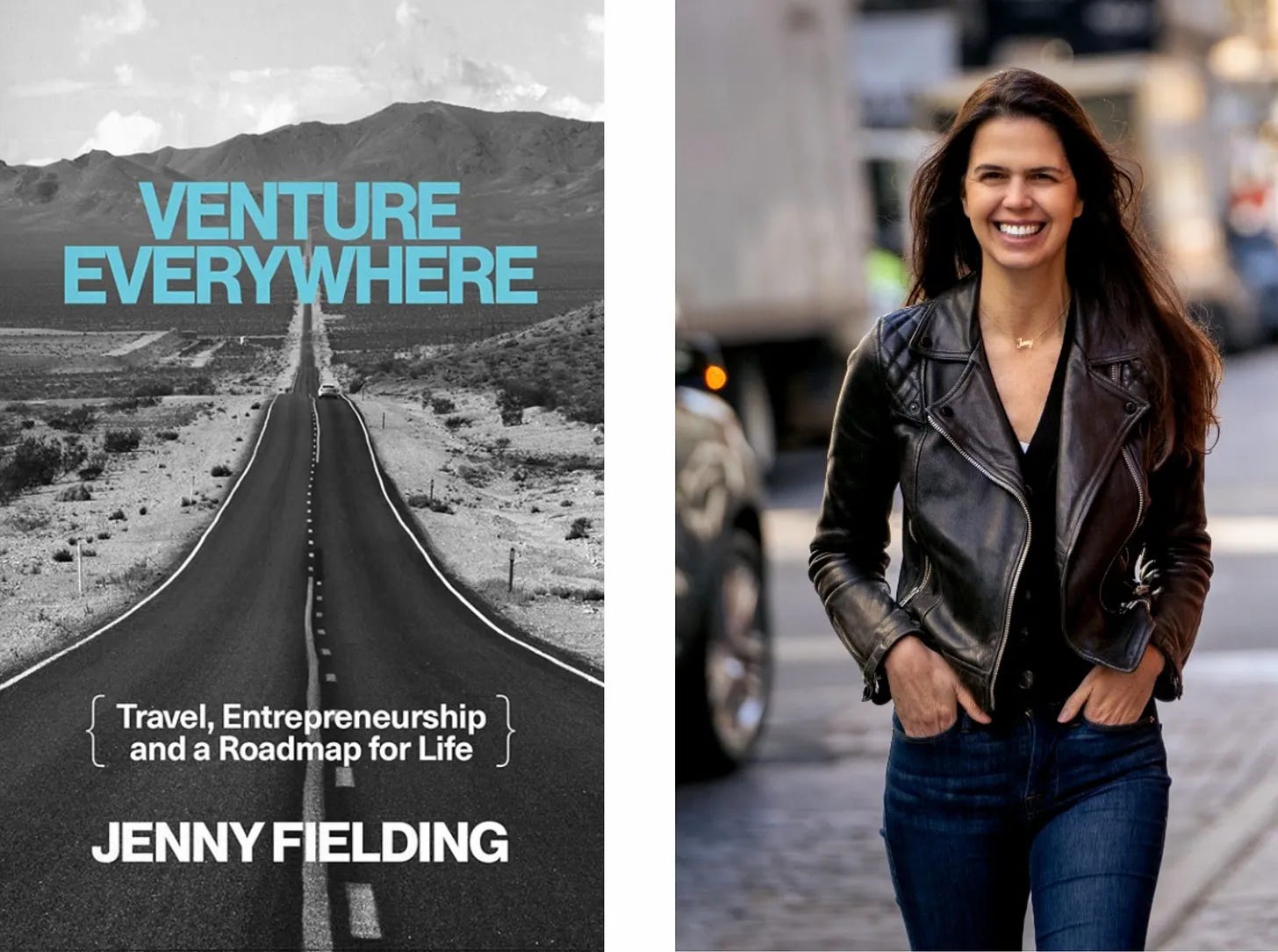

It's here! Jenny Fielding's debut book Venture Everywhere is available for purchase on Amazon, Barnes & Noble or your favorite bookseller. If you pre-ordered, happy reading!

Listen to Nathan Sutton with Federico Baradello on the Venture Everywhere podcast: Tangible Secondaries. Now on Apple & Spotify and check out to all our past episodes here!