In HBO’s Silicon Valley the obnoxious investor Russ Hanneman talks about the “Three Comma Club” in reference to the number of commas in a billion. In a recent Category Design workshop we held with Peter Goldie and Deborah Kattler Kupetz for our portfolio companies, we were introduced to the concept of the zero comma club, or the “Zero-Billion Dollar Market,” a concept they’d explored over past years that was popularized by Steve Vassallo of Foundation Capital, as well as endorsed by leading investors like Ann-Miura Ko at Floodgate, and funds like Sequoia Capital.

The notion of a Zero-Billion Dollar Market is that it’s something that you can see as an entrepreneur, but no one else believes. As we’ve talked about before, being consensus and correct is wonderful in many parts of life, but not in entrepreneurship. If you’re trying to create something new and valuable then it’s generally down the less traveled path, against the grain, and certainly not wildly obvious to others. Value is located when you’re both non-consensus, or contrarian, and also correct.

My friend Tommy Dyer recently alerted me to the fact that Don Quixote has been taught at Stanford Graduate School of Business (GSB), with particular focus on his “Lessons for Leadership.” Among other lessons, Quixote creates his own reality through action. Though often considered mad, particularly as he begins to see the windmills around himself as monsters, it’s perhaps all only in his imagination, and as Tommy delves into in his recent writings, perhaps it’s even him living in his own “reality distortion field,” to use the Steve Jobs turn of phrase. Indeed entrepreneurs must be Quixotic, or exceedingly idealistic, even impractical or “crazy” to invent new categories. “Here’s to the crazy ones. The misfits. The Rebels...” This is the edge between vision and reality where contrarianism dwells.

This is the land of Zero-Billion Dollar Markets, where some people will call you crazy for “tilting at windmills,” or imaginary monsters. Andy Grove, former CEO of Intel, wrote the 1999 book entitled “Only the Paranoid Survive.” Only those crazy enough to be out there in the arena, or on the journey, and also paranoid enough to tilt at windmills, survive long enough to create their own reality and new market.

So what’s better than a hundred billion dollar TAM? A Zero-Billion Dollar Market.

This is the one you’re inventing from the ground up, like Apple debuting the iPad, or Chrysler creating a new category of car in the Minivan. Five Hour Energy decided not to play the game of battling for the beverage aisle and instead decided to sell at point of sale, with a straight-forward name, and new form factor. Other examples abound, but one of particular interest over the last decade was the emergence of Qualtrics as the clear winner over Survey Monkey. Whereas at one point these “online survey” tools were indistinguishable, and in many ways, Qualtrics, sitting in Utah rather than Silicon Valley, was at the disadvantage, until Qualtrics decided to invest in defining their own category. In order to do this they looked at “the gap” between what CEOs or employees thought their company or product did, and what their customers did.

This “gap” between perception and reality has to be closed by better understanding your customers. Of course these could be called surveys, but by reframing the conversation around a market opportunity that hadn’t been tapped, and inventing the category of “Customer Experience” or CX, they became the creators of a Zero Billion Dollar Market. They were no longer playing the game of competition. They were the monopoly player in their own new invented world of CX, and through the course of an acquisition and later IPO spin out, they grew to nearly 15x the market cap of Survey Monkey over only a few years. This clear eruption in growth came from one thing: Narrative. Category creation isn’t simple marketing or new words, it’s internalizing this Quixotic spirit of inventing the world around you through action, even when others only see Windmills and think you’ve gone crazy, until you’re right.

A few key steps to finding your Zero-Billion Dollar Market:

Where is there a gap in society between reality and perception? Where has the hype cycle overshot, or what’s the underbelly of a major trend?

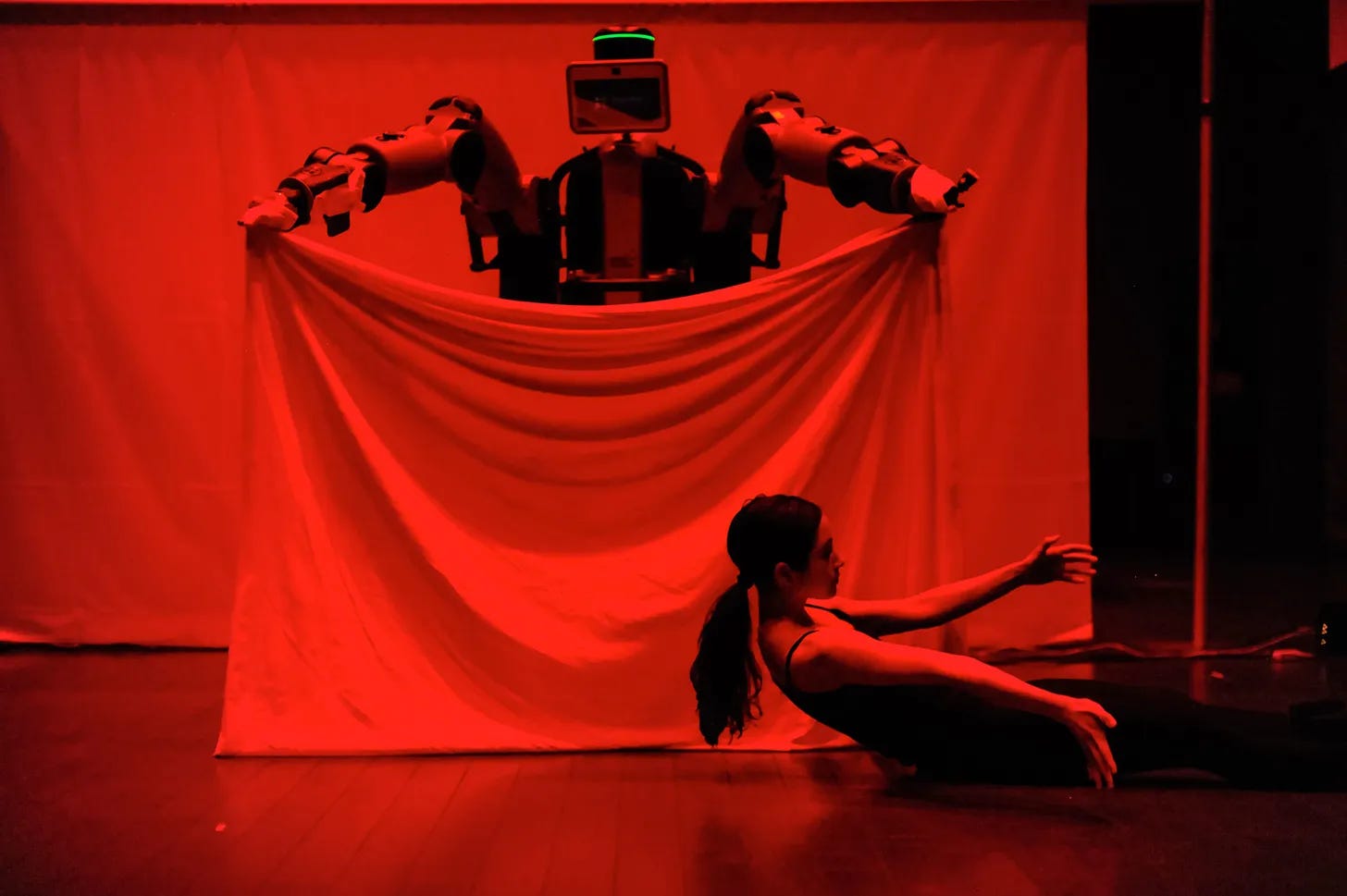

What unique skills or lenses predispose you to see two markets converging where others do not think there is overlap or opportunity? (e.g. Ballet + Robots)

Play what I call the “Animal Flip Book Game” of trying to mix and match industries you might understand with business models (SaaS, marketplace, etc). Do this to come up with non-sensical combinations that might lead to identifying Zero-Billion Dollar categories everyone else thinks are too crazy to chase. There’s nothing like an Elephant head, Giraffe body, Duck foot company that will weird people out to the point that you just might be contrarian, and right.

At Everywhere Ventures, one of our portfolio companies, Radicle Science, did the same. They observed what they call a “proof gap” between what customers believe supplements like melatonin do, and what they actually scientifically do. Radicle Science now offers clinical trials, or “Proof as a Service,” for companies in the less regulated supplements industry to prove to consumers and retailers what they do. Radicle Science created the market of democratized clinical trials. My friend Catie Cuan did in creating the field of Choreorobotics, or the blending of dance and robotics. She noticed a “trust gap” between man and machine that could be filled by adding graceful movement into the orchestration of robotics, particularly in medical environments where the goal of machines is to improve patient wellness, not increase anxiety. For years as a professional dancer no one understood her interest in both ballet and mechanical engineering until she completed her PhD at Stanford, and invented an entire new field of study now offered at universities such as Brown. She created an entire new category for herself, and other artists in technology, and is evidence of the value of plurality of interests, and the categories in their overlap.

In Joseph Heller’s Catch-22 if you asked not to fly dangerous missions you were deemed sane, and therefore had to fly. And if you were insane you were happy to fly and never thought to abstain. So the only those who could get out of missions where those unfit to fly, but if you identified as unfit to fly you were deemed sane and therefore were required to fly. In entrepreneurship it’s not an entirely dissimilar logical loop. On some level you need to be wildly Quixotic. “Crazy” enough to try something, and make your investor believe you are “swinging for the fences.” But at the same time you have to be measured and polished in how you communicate this mild insanity. You have to be fit to fly, and assemble a team of passengers alongside you, knowing that only crazy ones will sign up for this decade-long mission.

So be the one just crazy enough to invent the Zero-Billion Dollar Market you see, and then just sane enough to dominate the category you create for yourself.

Check out Everywhere with Scott on LinkedIn.

—

Scott Hartley is Co-Founder and Managing Partner of Everywhere Ventures. You can read more from him here.

Listen to Matt Biringer with Jenny Fielding on the Venture Everywhere podcast: Cloud Cover. Now on Apple & Spotify and check out all our past episodes here!